reit dividend tax rate 2021

Ad 5 Reasons Why We Think You Should Get Into Real Estate Investment Trusts. This simple one-pager shows the updated withholding tax rates for each country.

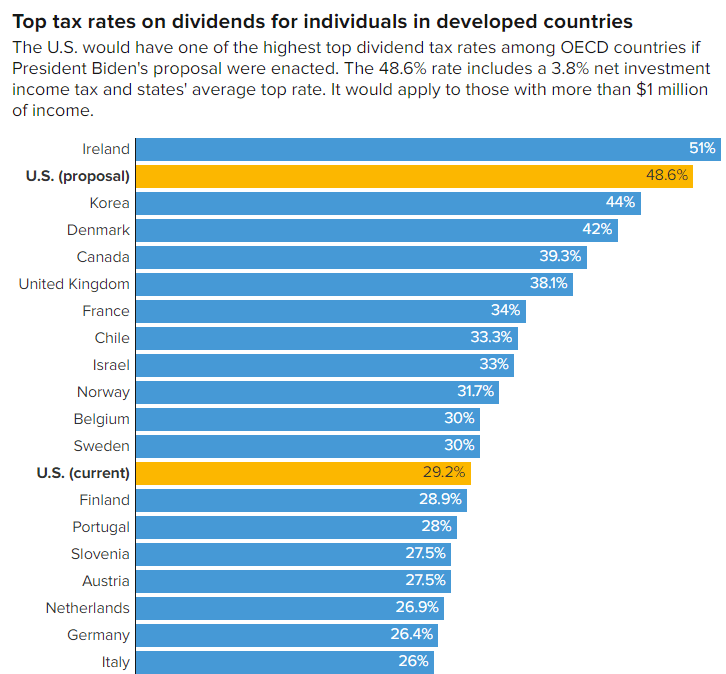

Biden S Tax Proposal And Tax Efficient Income Opportunities

BOSTON January 18 2022 -- BUSINESS WIRE --Plymouth Industrial REIT Inc.

. We have top picks to help you weather the storm. Reit dividend tax rate 2021 Thursday March 17 2022 Edit. Since 1988 founder David Lichtenstein has grown Lightstone to one of the largest privately-held real estate companies in.

Lightstone is a highly-regarded and diversified real estate company. Since a composite return is a combination of various individuals various rates cannot be assessed. Does the down market have you down.

Invest in Morningstar 4 and 5 Star Rated Funds. Ad Learn the basics of REITs before you invest any of your 500K retirement savings. Jamaica and no more than 25 of the REITs income consists of dividends and interest.

April 20 2021 Four is the new big number in Piscataway. Dividends from real estate investment trusts or REITs are considered taxable income in the eyes of the IRS but theres much more to the story than that. Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel.

As of July 2021 its annual dividend was 228 for a yield of 586. Qualified dividends get special tax treatment and are taxed at the same rates as long-term capital gains between 0 and 20. However the income thresholds.

Therefore the composite return Form NJ-1080C uses the highest tax bracket of. Taxation considerations for income from investing in InvITs and REITs. PLYM announced the tax treatment of its 2021 dividends to common stockholders.

For 2021 these rates remain unchanged from 2020. Ad We Offer Over 60 Funds With 4 5 Star Ratings From Morningstar. 30 tax rate if shareholder owns 25 or more of the REITs stock.

Get your free copy of The Definitive Guide to Retirement Income. 15 tax rate if shareholder. Piscataway Township hits a four-year stride with a 128 percent lower municipal tax rate.

Any money distributed by an InvIT or REIT like interest dividend or rental income for. STAG Industrial STAG STAG Industrial STAG invests in industrial-use properties mostly. Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen.

This provision qualified business income effectively lowers the federal tax rate on ordinary REIT dividends from 37 to 296 for a taxpayer in the highest bracket. The Dividend Withholding Tax Rates by Country for 2021 has been published by SP Global. The Federal income tax classification of the distribution per share on the Companys 775 Series A Preferred Stock with respect to the calendar year ended December.

County Equalization Tables. MAC - MACERICH ANNOUNCES TAX TREATMENT OF 2021 DIVIDENDS. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

SANTA MONICA Calif Jan. 2021 Taxable Ordinary Dividends. Ordinary dividends are taxed at ordinary income.

The tax rates for non-qualified dividends are the same as federal ordinary income tax rates.

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof

A Complete Guide To Equity Reit Investing Money For The Rest Of Us

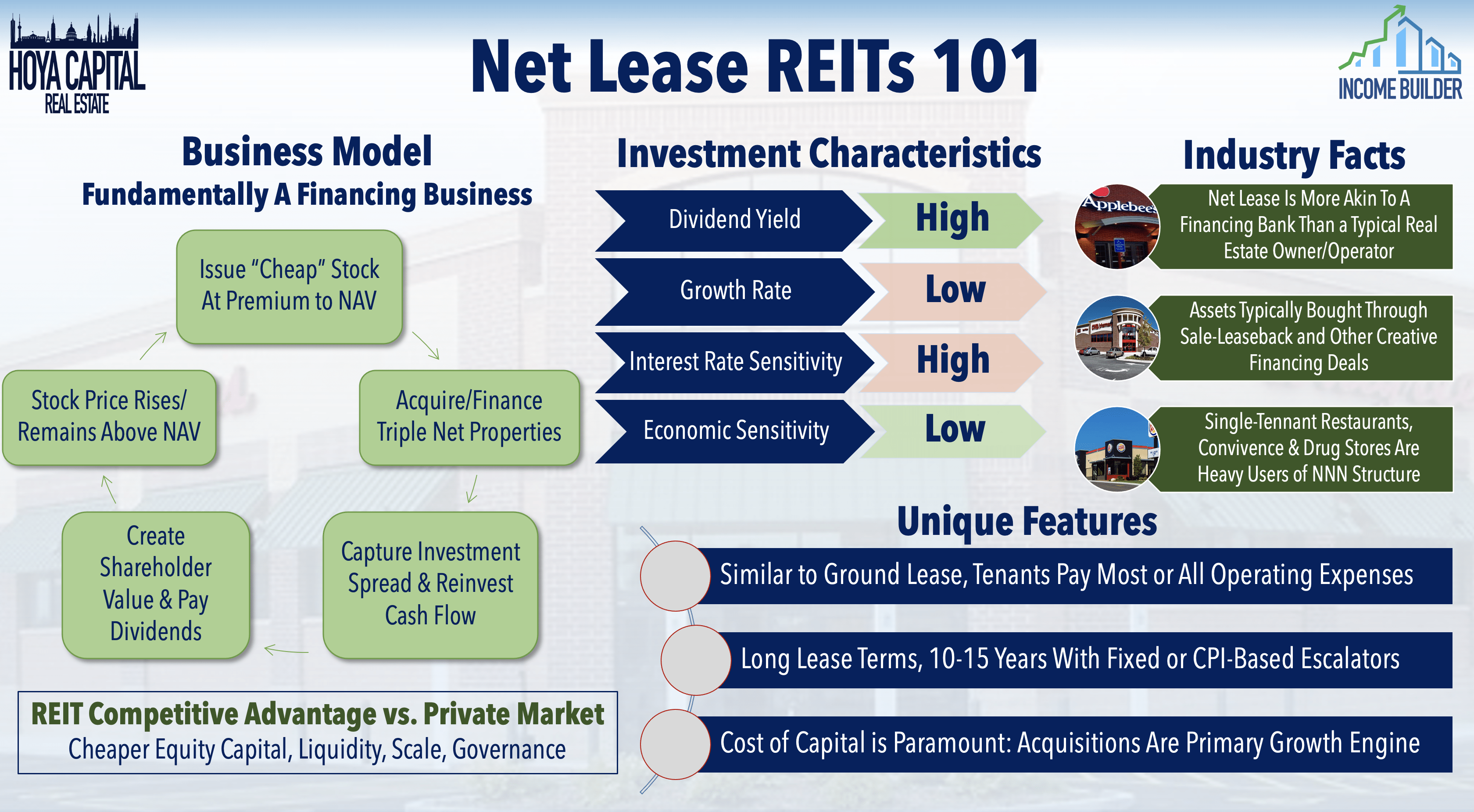

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha

Dividend Tax Rates For 2021 And 2022 Personal Capital

Sec 199a And Subchapter M Rics Vs Reits

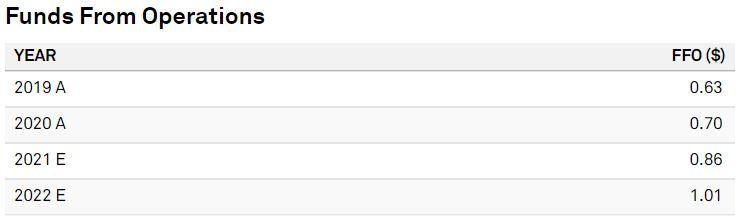

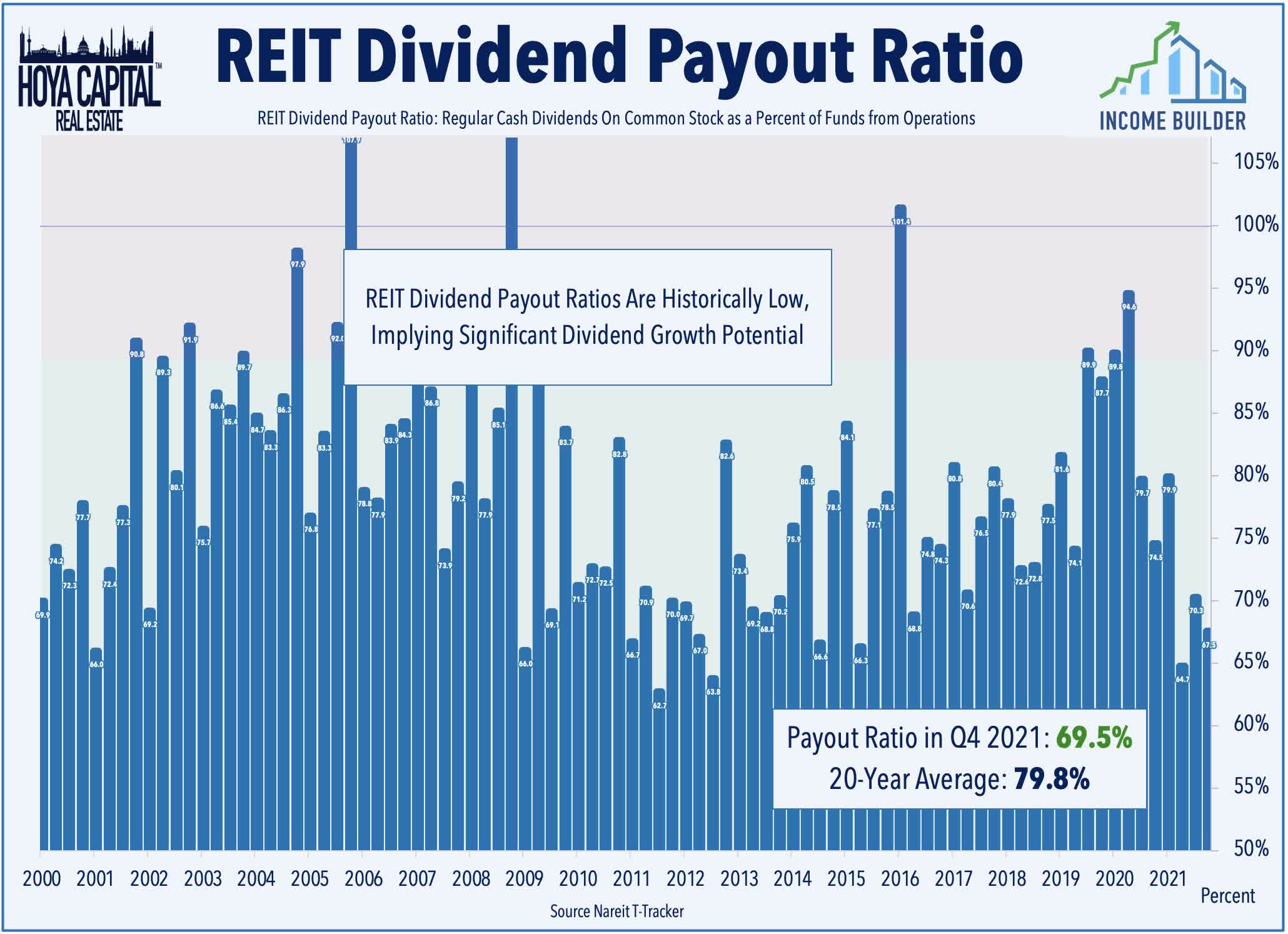

Reit Earnings Preview Dividend Hikes 2022 Outlook Seeking Alpha

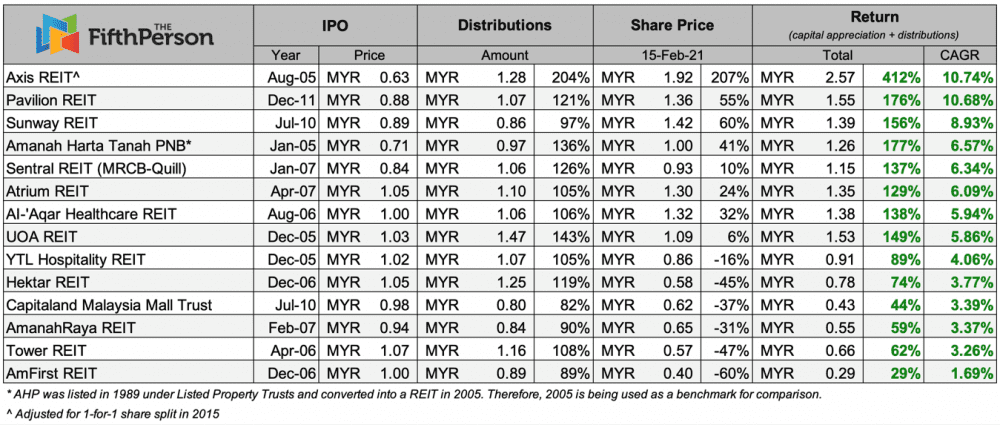

How To Invest In Malaysia Reits For Passive Income A Beginner S Guide

Doing Business In The United States Federal Tax Issues Pwc

Tax Aspects Of Investing In Reits And Remics The Cpa Journal

How To Pay No Tax On Your Dividend Income Retire By 40

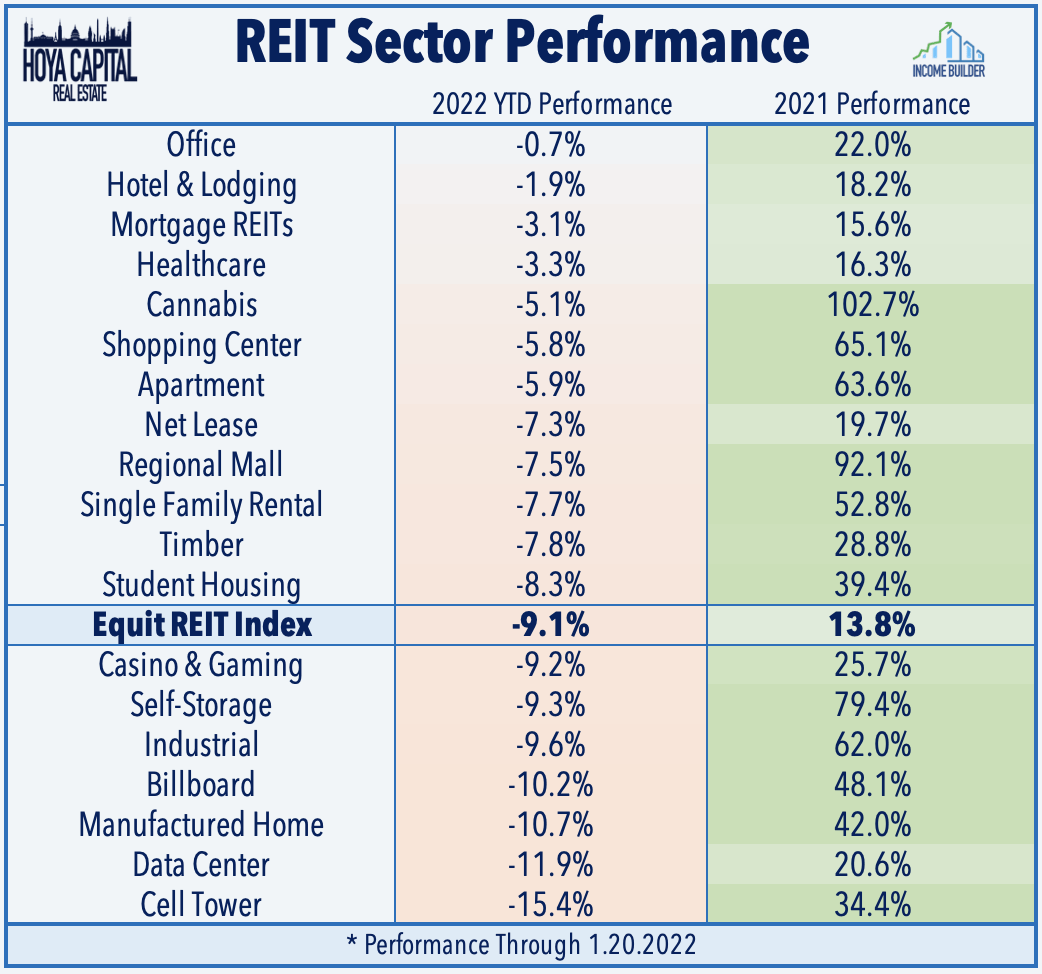

State Of The Reit Nation Seeking Alpha

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha

Taxation On Embassy Reit Dividend Stocks Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

Rates Up Reits Down Not So Fast Seeking Alpha

Biden S Tax Proposal Impact On Stocks And How To Use Reits For Tax Advantages Seeking Alpha

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/REITS-97da07bc319a447a91c2a8c274c28712.jpeg)